NOTE: Bloomberg Second Measure launched a new and exclusive transaction dataset in July 2022. Our data continues to be broadly representative of U.S. consumers. As a result of this panel change, however, we recommend using only the latest posts in assessing metrics, and do not support referring to historical blog posts to infer period-over-period comparisons.

Consumer transaction data reveals that sales for the home improvement industry skyrocketed early in the pandemic as many consumers stayed at home during shelter-in-place orders. A year and a half later, home improvement sales are still higher than pre-pandemic levels, but sales growth at major hardware store chains did not maintain the same momentum in 2021 as it did in 2020. At the same time, the average transaction value for home improvement companies has increased year-over-year.

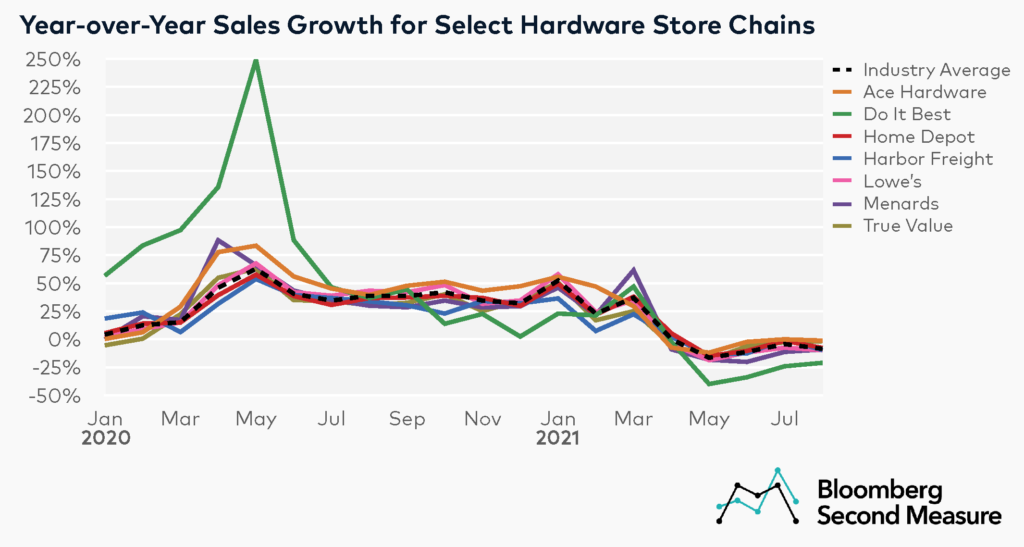

When shelter-in-place orders first went into effect, hardware store chains experienced a significant boost in year-over-year sales. Among a selection of home improvement companies (Ace Hardware, Do It Best, Home Depot, Harbor Freight, Lowe’s, Menards, and True Value), combined sales increased 45 percent year-over-year in April 2020 and 62 percent year-over-year in May 2020. Do It Best saw the most sales growth during this period, with 135 percent year-over-year growth in April 2020 and 249 percent year-over-year growth in May 2020.

One likely factor in the rise of hardware store sales is that home improvement projects became popular when shelter-in-place orders went into effect, as consumers adapted their living spaces to accommodate new needs for working, studying, and entertaining themselves at home. The housing market also boomed during the pandemic, and new homeowners may have undertaken renovation projects. Interestingly, sales for DTC furniture companies rose at the same time as hardware sales, underscoring the trend of consumers spending more on their homes.

Sales growth for hardware store chains slowed in the latter half of 2020 and into 2021. In fact, from April 2021 through August 2021, the average growth rate for home improvement sales was negative. In August 2021, combined sales for home improvement companies decreased 9 percent year-over-year. Sales at Do It Best declined 21 percent year-over-year in August 2021, while sales at Ace Hardware and True Value only declined 2 percent year-over-year. Despite slowing or negative growth rates, 2021 sales at all hardware store chains in our analysis are still higher than pre-pandemic levels.

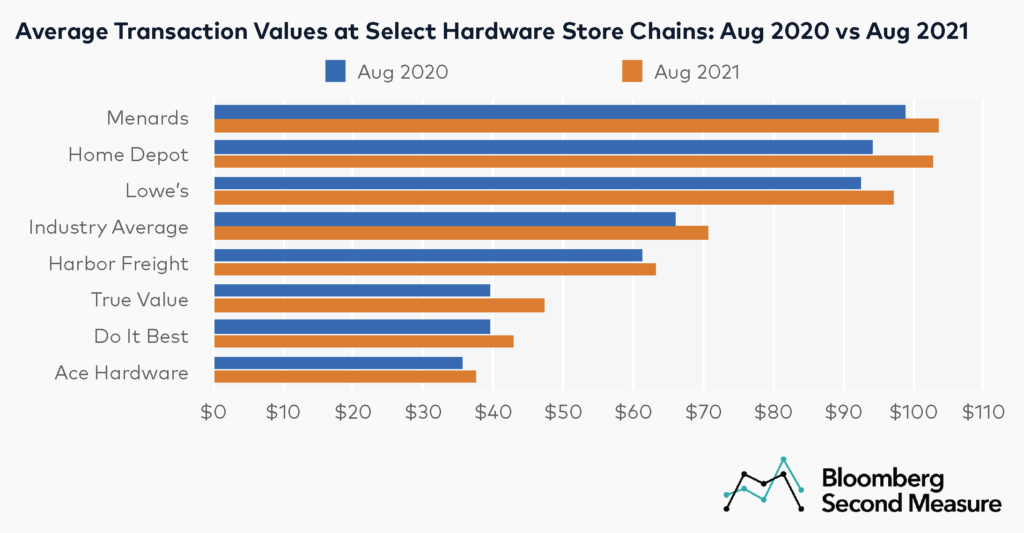

Average transaction values for hardware store chains have increased

Consumers are also spending more at all home improvement companies in our analysis compared to the same time last year. The overall average transaction value for the companies in the analysis was $71 in August 2021, compared to $66 in August 2020—an increase of 7 percent year-over-year.

The biggest difference in average transaction value was for True Value, which experienced an increase of 20 percent year-over-year. Harbor Freight had the smallest change in average transaction value, with only a 3 percent year-over-year increase. In both August 2020 and August 2021, the average transaction value was lowest at Ace Hardware, while it was highest at Menards.

*Note: Bloomberg Second Measure regularly refreshes its panel and methods in order to provide the highest quality data that is broadly representative of U.S. consumers. As a result, we may restate historical data, including our blog content.